- Home

- About Us

- Products

- Molded Case Circuit Breaker

- Air Circuit Breaker

- Miniature Circuit Breaker

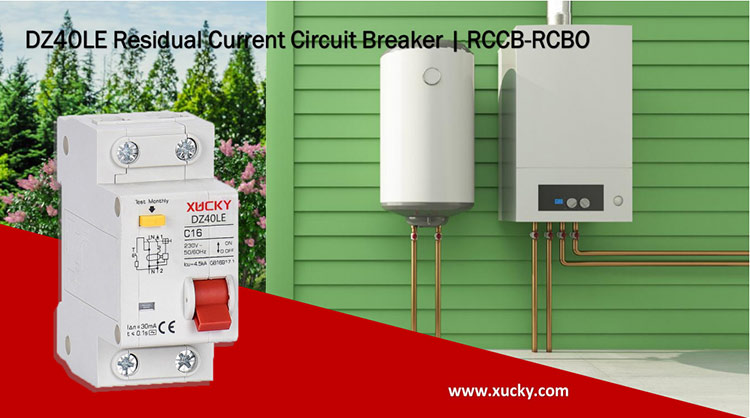

- Residual Current Circuit Breaker

- RCBO

- Changeover Switch

- EV Charger

- Contactor

- Thermal Relay

- Motor Protection Circuit Breaker

- Switch and Socket

- Distribution Box

- Voltage Protection Device

- Automatic Transfer Switch

- Surge Protective Device SPD

- Inverter

- Fuse

- Pushbutton Switch

- Vacuum Circuit Breaker

- Load Break Switch

- Insulator

- Lightning Arrester

- Drop Out Fuse Cutout

- Disconnecting Switch

- Earth Switch

- Transformer

- Impulse Relay

- Timer Switch

- Blog

- Download

- Send Inquiry

- Contact Us